In April 2019, I blogged about the negative unemployment impact on employee benefits, because our roaring economy had produced more jobs than the number of people looking for a job. But, by April 2020, the COVID-19 pandemic panic plunged the labor market into chaos.

The government responded through significant unemployment programs, business support payments, and three rounds of stimulus payments to individuals. These circumstances and actions have put employers into an unprecedented labor market as we gear up to celebrate Labor Day in 2021.

The following charts represent a few of the primary pieces to this complicated labor puzzle.

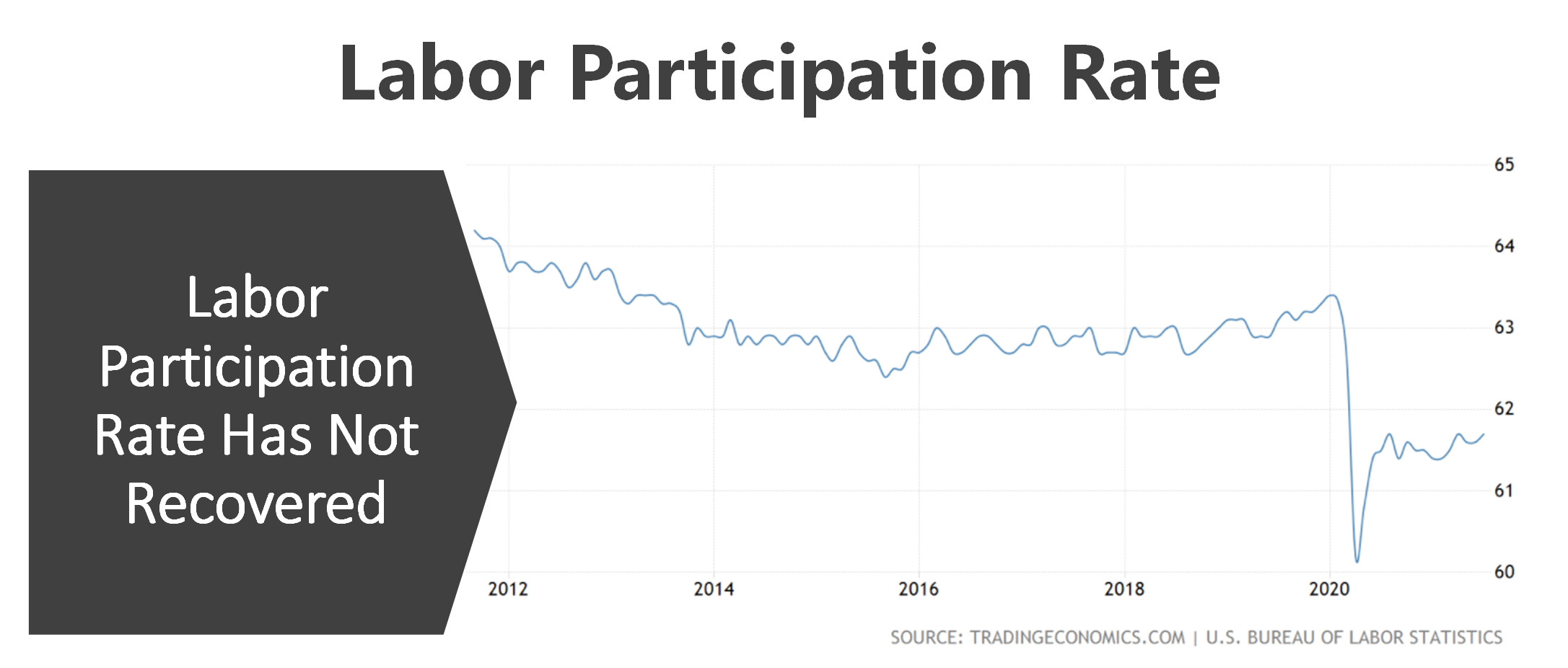

Labor Participation Rate

The labor participation rate represents the percentage of the adult population that is either employed or looking for employment. It’s a critical factor in an economy’s ability to grow. More workers mean more growth potential in the economy.

The rate has dropped in the previous two decades, but it plummeted with COVID-19. It has partially bounced back, but a lower percentage of the population is currently choosing to work or to seek employment. A higher percentage of potential workers have opted out of the labor pool.

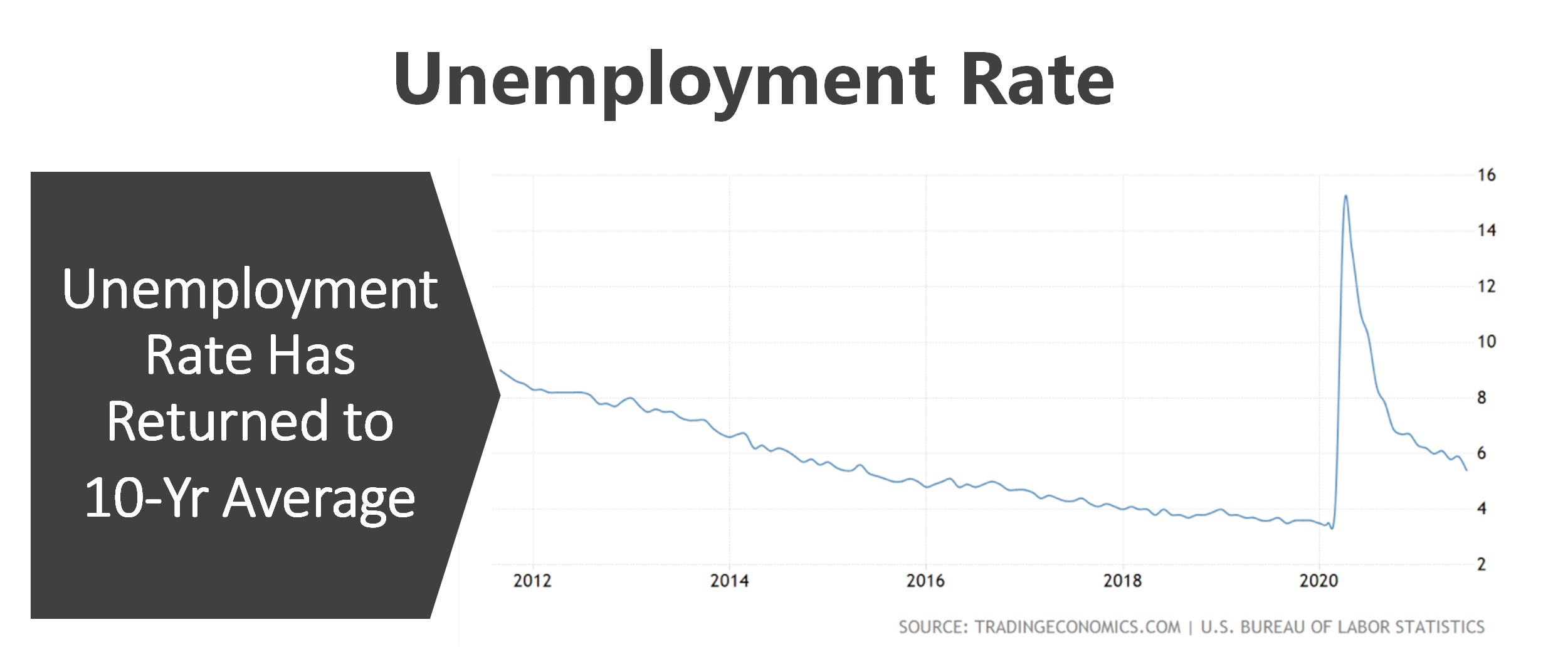

Unemployment Rate

The unemployment rate skyrocketed at the onset of the pandemic. It has since fallen significantly and currently sits near its 10-year average.

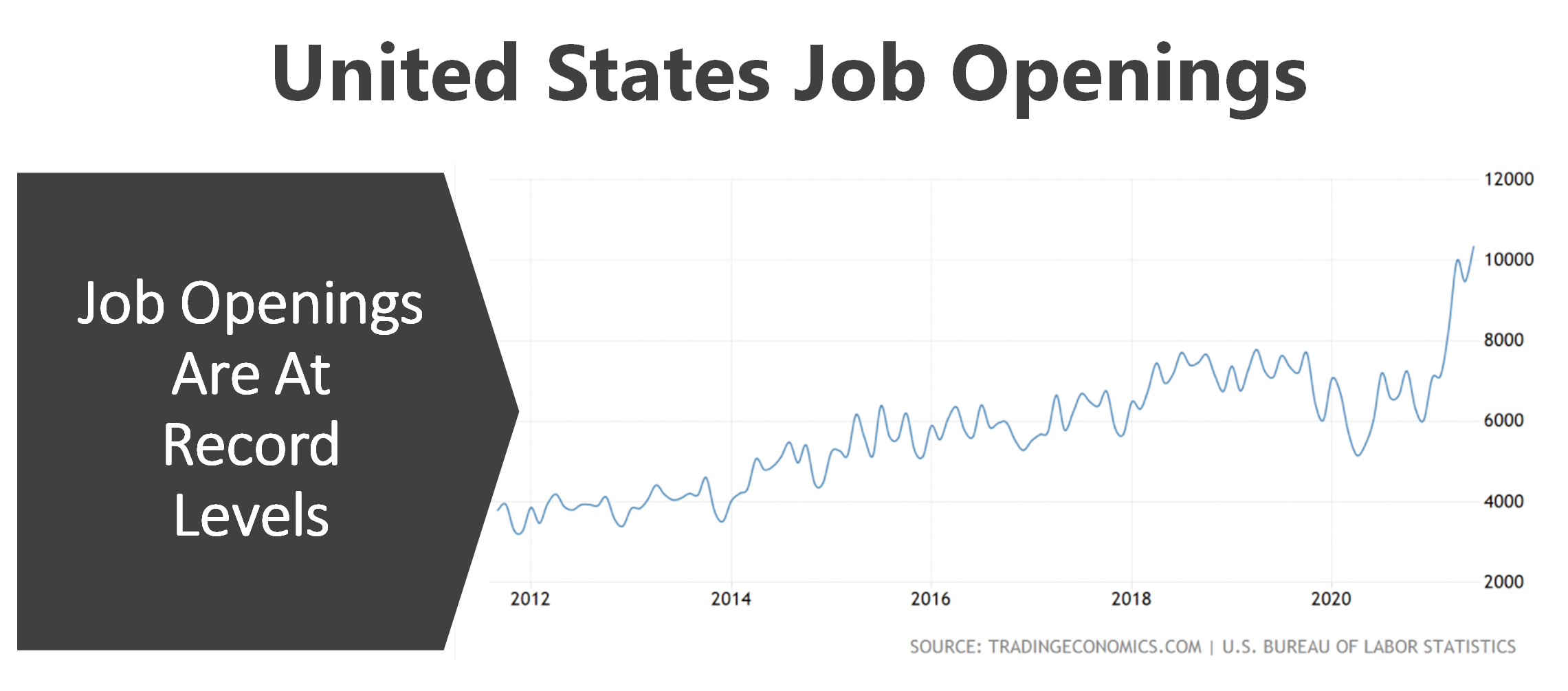

U.S. Job Openings

When it comes to job openings in the U.S., they are at record levels. Corporations have record earnings, and they are looking to hire.

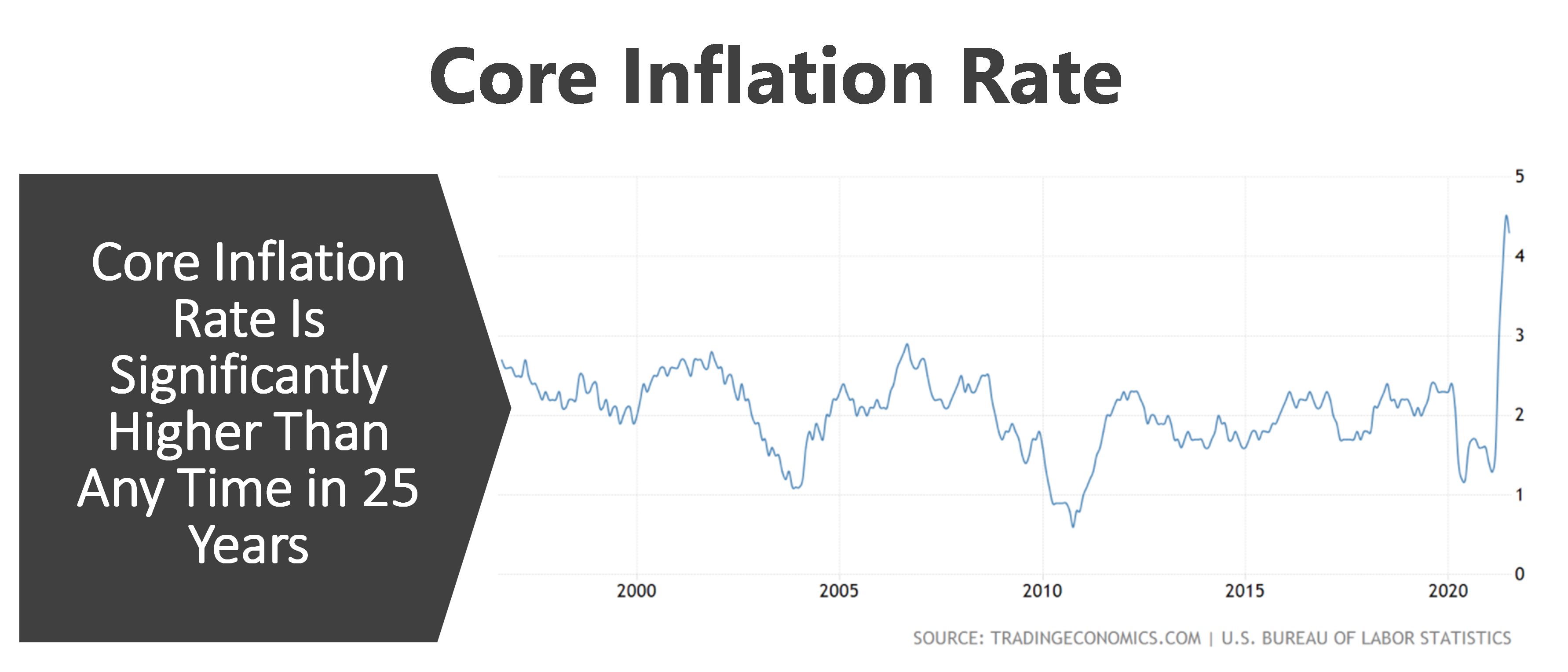

Core Inflation Rate

Finally, the core inflation rate is significantly higher than it has been at any point in the previous 25 years.

Impacts to Employer Healthcare Prices and Rates

So, what does this mean for employer healthcare prices and rates going forward?

The tight labor market and resulting increased cost of labor, price inflation for all goods and services including healthcare, the pent-up patient demand from delayed services, the lost revenue for medical providers because of delayed elective procedures, the health status deterioration from delayed screenings and COVID-19 stress, and the absence of pressure from the federal government as Medicare For All and even Public Option discussions have disappeared all point to a pending rise in medical inflation for employers beginning in 2022 and beyond.

I wish my crystal ball showed me something different, but I believe employers need to start planning now for how to create better value for every dollar they are investing in healthcare.

If you need help doing this, we have experts on hand who are well-versed in employee benefits plans and what you need to know and look out for. Don’t hesitate to reach out!