The concept of underwriting goes back to the very roots of insurance. As ships began to sail between England and the New World, investors would sign their names under a ship’s manifest, and so was born the term underwriting. The investors would receive a premium and would take a share of the loss if something happened to the ship and/or cargo. This sharing of risk allowed business owners to take the chance of sailing and trading in the New World. The balance between risk and reward is the basis of all underwriting.

The Affordable Care Act (ACA) created a system of underwronging in the individual health insurance market. Underwronging is the process of manipulating numbers because you don’t like the answer that mathematics and statistics produce. The implementation of underwronging creates an almost insatiable appetite for subsidy and for continual manipulation. Just because the government mandates that 2 + 2 = 3 in insurance, it does not mean that 4 is not the answer in the end.

Insurance pricing is based on both predicting and pooling risk. Enhanced predictability leads to greater competition among bidders. The ACA outlawed many of the common health insurance underwriting factors that are used to more closely align risk and premium. Limiting or eliminating the following underwriting pricing elements created uncertainty for insurance companies:

- Industry—The health insurance of small companies was priced based on the common risk characteristics of the typical workforce in their industry. The ACA outlawed this practice.

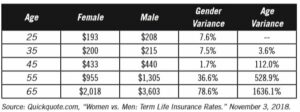

- Gender—Young women paid more for health insurance than young men. Older men paid more for health insurance than older women. The health insurance rates prior to the ACA reflected the aggregate claims history by gender. The ACA made rates gender-neutral.

- Claim History and Preexisting Medical Conditions—Insurance companies could either increase prices or deny coverage for individuals with known medical conditions. The ACA outlawed preexisting-condition limitations.

- Risk Factors—Known risk factors, such as obesity and tobacco use, were factors in determining rates. The ACA allowed tobacco to continue as a risk factor that could increase premiums, but all other risk factors have been eliminated from pricing.

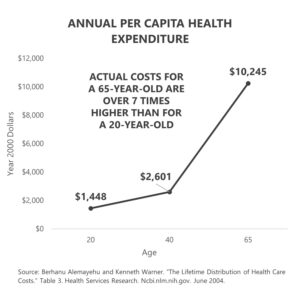

- Age—The cost of health insurance increases with age because claims risk increases with age. The rate and amount of increase may be shocking to the insurance novice. The claims risk for a sixty-four-year-old man is approximately 6.5 times greater than the claims risk for a twenty-five-year-old man. (1) Prior to the ACA, an insurance company’s prices reflected the insurer’s actuarial projection for claims by age. The ACA created a standardized age scale that applies to individual health insurance. The standardized scale caps the difference between the lowest-cost and highest-cost participant at three times the lowest rate.

The early years of the Marketplace have been defined by uncertainty. Uncertainty in insurance leads to volatile pricing, and that is what has been experienced. Insurance carriers were worried that the mix of unhealthy-to-healthy and old-to-young participants would not be favorable. The rate stability of the pool for an insurance company is based on the company’s ability to accurately forecast risk. If a higher percentage of the enrollment was for older and/or sicker people, the rates would be inadequate and would become volatile. This is exactly what happened in the Health Insurance Marketplace. The national average monthly premium for the benchmark second-lowest silver plan increased from $218 in 2014 (the first year of the Marketplace) to $411 in 2018. That is an 88% increase in only four years. (2)

Underwronging and the Health Wars

Every political campaign loves to have a villain and victim. It sets the perfect stage for the politician to be the rescuing hero. Two fictitious “wars” have been created on the healthcare front: the war on women and the war on aging. We’ll take a closer look to see if there really are weapons of mass healthcare destruction here, but before we do, let’s look at two other types of insurance.

Life Insurance Example

The federal government does not mandate that any individual purchase life insurance. The federal government has not created a life insurance underwronging system, and it does not provide a formal life insurance subsidy system for individuals between 100% and 400% of the FPL. Preexisting conditions have a huge impact on your ability to purchase life insurance and on the rate you will pay. Life insurance is an actuarially pure business.

This may not surprise you, but there is tremendous gender discrimination in life insurance. Base life insurance rates for women are lower than base life insurance rates for men of the same age.

Wait! There’s more. Life insurance rates also discriminate against older people. According to one life insurance insider, a healthy sixty-five-year-old man will pay over sixteen times as much for life insurance as a healthy twenty-five-year-old man. Somebody call Congress!

Of course, life insurance rates vary based on age and gender because mortality risk also varies based on age and gender. On average, men die younger than women, and older people die more frequently than younger people. The insurance costs simply reflect the risk reality. There is no war in life insurance.

Automobile Insurance

I have two children who were born in September in consecutive years. The older is a boy, and the younger is a girl. I added each of them to our car insurance when they turned sixteen and got their licenses to drive. The cost increase for adding my son was greater than the cost increase for adding my daughter. Both were “A” students, and neither had had an accident (since they were just starting to drive). How could the car insurance company arbitrarily charge my son more than my daughter? It was purely based on gender. Talk about a war! The car insurance companies are waging a war on boys! Somebody call Congress!

I get it. Boys have more frequent and more severe automobile accidents than girls. Therefore, car insurance companies charge teenage boys more than teenage girls for car insurance, based on the historic claims they have seen from other boys and girls. Car insurance rates simply follow predictable historic claim patterns and risk. There is no war on boys in car insurance.

The War on Women in Health Insurance Pricing

I am not here to say that America has not struggled, and does not currently struggle, with gender, race, age, or other bias issues. I am confining my comments solely to health insurance pricing. Health insurance premiums have been included as a weapon in the war-on-women battle cry. The ACA eliminated gender as a rating factor for health insurance, and rates are now gender-neutral. Prior to the ACA, insurance companies typically charged women higher rates than men. This was particularly prevalent in younger adults aged 18–44. A ten-year study by the Office of the Actuary for the Centers for Medicare and Medicaid Services found that actual health insurance claims for working-age women were consistently higher than for men at the same age. (3) The average annual health claim spending for women ages 19–44 was 78.6% more per person than for men of the same age group. The pricing-discrimination question is whether it was appropriate to charge a group with measurably higher costs more for health insurance.

Any inclusion of the possibility of women paying more for health insurance than men as part of a war-on-women dialogue is inappropriate. The war on women in health insurance pricing was no more real than the war on boys in car insurance.

The War on Aging

The ACA compressed the age factors in health insurance pricing. The pricing of individual health insurance no longer aligns with actuarial age-based risk.

My analysis of individual health insurance rates prior to the January 1, 2014, implementation of the ACA underwriting and pricing laws indicated that in Texas, a sixty-four-year-old man would pay approximately 6.5 times what a twenty-five-year-old man would pay for the same coverage. These health insurance prices aligned with actuarial studies of health cost by age. The ACA capped the highest rate at three times the lowest rate. The net effect is that younger participants are subsidizing the health insurance cost for older participants.

This rate manipulation creates potential instability in the health insurance market. Insurers must accurately predict enrollment by age, since rates do not align with risk. Republican proposals to repeal and replace Obamacare included a provision that would change the age-based underwriting ratio from the current 3:1 to 5:1. In essence, the Republicans were still supporting age-based rate compression, but they were splitting the difference between the 3:1 ACA ratio and the true 6.5:1 underwriting risk. Their thought was that rates that better reflected risk would be more stable over time and might better attract young participation. The result would have been lower rates for young participants and rate increases for older participants.

In my congressional district, a Democratic candidate for the House of Representatives successfully used an “age tax” ad as a key part of a healthcare ad campaign to unseat an incumbent Republican. The age tax to which the Democratic campaign was referring is the Republican-proposed move from a 3:1 to a 5:1 age ratio in individual health insurance pricing, under which older participants would be charged five times the cost of the youngest participants, rather than three times. The 5:1 ratio would lower the cost for younger participants but raise the cost for older participants. It also more closely reflects the actuarial cost risk. Was the Republican proposal to move age-based rates closer to actuarial reality a war on aging or a war on unsound insurance regulation? Healthcare is complicated. The ACA is complicated. The combination of a complicated industry and simple campaign sound bites is dangerous.

What’s Next?

The government has permanently inserted itself in the manipulation of health insurance pricing. Any material moves to better align prices with actual risk would be politically risky. Young voters would be frustrated if they understood how the ACA-mandated pricing manipulation raised costs for them. A move to appropriately lower costs for younger Americans would raise costs for older Americans, angering the older ones. It is difficult to remove or correct price manipulation once established.

Speaking of pricing, don’t forget to tune in next week, where I’ll take a look at a little something called “price discrimination.” What is it, and is it really happening? And, if you haven’t already, I encourage you to sign up for the “Insiders’ Club” where you’ll be notified when I release new information AND receive a FREE copy of my book “The Voter’s Guide to Healthcare: A non-partisan, candid, and relevant look at politics and healthcare in America” when it’s available.

Sources

- (1) Berhanu Alemayehu and Kenneth Warner. “The Lifetime Distribution of Health Care Costs.” Table 3. Health Services Research. Ncbi.nlm.nih.gov. June 2004.

- (2) ASPE Research Brief. “Health Plan Choice and Premiums in the 2018 Federal Health Insurance Exchange.” Aspe.hhs.gov. October 30, 2017.

- (3) Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group. “Health Expenditure by Age and Gender, Table 27.” Cms.gov. April 26, 2019.