Republicans found a unifying rallying cry in “repeal and replace.” While campaigning, they were never forced to answer the question “Replace with what?” The fuel was resentment of Obamacare and resentment for the Democrats who had forced Obamacare down their legislative throats. The political campaign power was really more of a “repeal and erase” outcry. The voter response to “repeal and replace” was real, and it was powerful.

Democrats may have found their rallying cry in “Medicare for all.” So far, they have been just as effective as the Republicans in not defining exactly what this means or how it would be funded. The term “Medicare for all” is as offensive to Tea Party Republicans as a MAGA hat is to Socialist Democrats. Medicare for all may or may not make it through the gauntlet of the Democratic primaries, but it is a poke in the eye to Republicans, as it proclaims not only that Obamacare is alive and well but also that Obamacare was not enough. Effectively, Medicare for all is the Democratic repeal-and-replace rallying cry, but what exactly is Medicare for all?

Medicare for All…Popular but confusing

I will always remember the 2016 Bernie Sanders presidential campaign for one thing. No, not that a self-proclaimed Democratic Socialist who isn’t officially a Democrat almost beat the most established of the Democratic establishment in the primary. I will remember how crowds reacted when Senator Sanders said, “Medicare for all,” rather than “single payer.” The phrases could possibly be used synonymously, but the crowd reaction is very different. Single payer sounds limited, restrictive, autocratic, and “governmenty.” Medicare for all sounds inclusive, friendly, and safe. It literally sounds more American.

The problem with this branding is that Senator Sanders’ legislation abolishes the current public-private Medicare program completely and replaces it with a single-payer system. Other candidates are now supporting an idea of Medicare for all that applies the current Medicare program as universal coverage for everyone. The Medicare expansion proposals also expand eligibility into the current Medicare system. Voters have become confused as to what candidates are proposing when they refer to Medicare because the candidates mean different things but use the same word.

An October 2018 poll found that 79% of Americans supported Medicare for all. This included 85% of Democrats and even 52% of Republicans. (1) The public appeal of these three words can help you understand why candidates rushed to support Medicare for all.

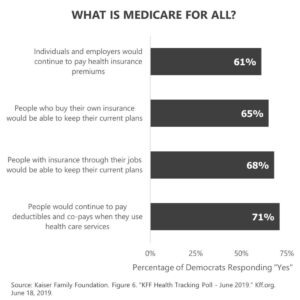

A June 2019 Kaiser Family Foundation survey asked Democrat potential voters about some key elements of Medicare for all, including whether people and companies would still pay premiums, whether people could keep their current plans, whether they could keep employer-sponsored coverage, and whether people would still have deductibles. The correct answer to each question, according to the proposed Medicare for all legislation, is no. The majority of Democrats incorrectly answered yes to each question.

Popularity of Medicare for all is dropping as people are learning more about what the term might, or might not, mean. A July 2019 poll showed that support for Medicare for all had dropped to 53% of all voters, and Republican support for it had fallen to 27%. (2) Although public opinion of the term is falling, it is still supported by a majority of voters.

Medicare for None

Senator Bernie Sanders authored proposed legislation entitled the Medicare For All Act of 2017. This proposal deserves special attention because it was cosponsored by seventeen senators, including Cory Booker, Kirsten Gillibrand, Kamala Harris, Jeff Merkley, and Elizabeth Warren—all of whom have either formally explored or declared their candidacy for the 2020 presidential election. What exactly did Senator Sanders author and the others cosponsor?

If Medicare were a private industry brand, then Senator Sanders and his Medicare for all proposal would be sued for copyright infringement or deceptive trade practices. Although I am confident it would not be popular at a campaign stop, the more appropriate name for the proposed plan is “Medicare for None” because it abolishes Medicare and virtually all of its existing structure and elements. In my mind, Medicare for all would mean that the existing Medicare program is the coverage that all Americans receive. Therefore, for clarity, I will refer to Senator Sanders’ proposal as Medicare for None.

How Does It Work?

- Universal Coverage—Everyone is covered by a single government program after a four-year phase-in.

- No Out-of-Pocket Expense—Eliminates all cost sharing when a person uses the healthcare system.

- Provider Reimbursement—Medicare reimbursement applies for all services.

- Establishes the Agency for Healthcare Research and Quality.

- Prohibits the Sale of Private Insurance, Employer-Sponsored Insurance, and Individual Insurance for services covered under the Universal Medicare Program. It is a single-payer system.

- Abolishes Current Medicaid, CHIP, and Medicare plans into the new Universal Medicare Program that covers everyone.

How Is It Funded?

Medicare for None exchanges premiums for taxes. Premiums for health insurance would no longer be required, but new taxes would be implemented to pay for the program. Although the proposed Medicare For All Act did not include a formal funding proposal, Senator Sanders released options for funding of the Medicare For All Act that provide an indication of required funding. The following is a summary of how the act would be funded:

- a 7.5% employer-paid income tax

- a 4% household income tax for households above $29,000 in income

- $4.2 trillion in additional taxes from the elimination of employer-sponsored health insurance

- tax increases for those with income greater than $250,000 (marginal rates would range from 40% up to 52% in the highest bracket)

- taxing capital gains at income-tax rates

- cap all tax deductions at 28% for households at or above $250,000

- more progressive and aggressive estate tax

- establish a net-worth tax on the top .1%

- eliminate the Gingrich-Edwards S-distribution loophole

- impose a one-time tax on held offshore profits

- impose a fee on large financial institutions

- repeal last-in, first-out (LIFO) accounting

The ten-year cost estimates range from around $32 trillion to $37 trillion. At first glance, this seems like a staggering cost. It is, however, important to note that these cost estimates are less than the total projections for national health expenditures over ten years under the current system of public and private insurance. Medicare for None would cost substantially less in total than the current healthcare system. Negative comments from opponents who criticize the total cost either fail to recognize or choose to ignore that Senator Sanders’ proposal is a net reduction in cost. The big financial difference is that all the funding is consolidated under federal government authority.

Medicare for All

Although Senator Kamala Harris is a cosponsor of Senator Sanders’ proposed legislation, she has separated from him in her definition of Medicare for all. Senator Harris’ Medicare For All Plan makes some changes to the current Medicare system but does allow private insurance as an alternative to the public program. It is very similar to current Medicare Advantage programs that provide a private alternative to traditional Medicare. The Harris Medicare For All Plan would transition all people into either the government Medicare plan or the Medicare private option over a ten-year period. Her plan allows anyone to opt in to the Medicare plan immediately if desired. (3)

Senator Harris supports many of Senator Sanders’ funding ideas; however, she proposes that households earning below $100,000 per year be exempt from the new 4% income tax.

Although Senator Harris’ plan is short on details, it does appear that it accomplishes many of the same goals of the Sanders’ plan and could appropriately be called Medicare for all because it is based on the current Medicare program.

The Case for Medicare for All

Medicare for all is the social-justice champion. Ability to pay would never again be a factor in access to healthcare services in America. It solves the uninsured and all individual-affordability problems.

Medicare for all is simple. Everyone is covered by the same public health insurance program, and it does not cost the individual anything when the individual accesses the healthcare system for services. It is significantly more administratively efficient. Medical providers do not have to have today’s billing or collection services because they don’t bill patients or insurance companies.

Patients don’t have to deal with medical bills. Healthcare is truly “free” for the patient at the time of service.

Medicare for all lowers healthcare costs. I believe it is fair to say that Medicare for all saves money, even though it increases federal government expenditures. It simply concentrates all the money that is paid by the government, companies, and individuals for healthcare services into one government-controlled financing pool.

The social-justice, simplicity, and lower total cost wins will be appealing to many voters.

The Argument Against Medicare for None/All

The opponents of Medicare for all worry about the economy, healthcare access and innovation, and government overreach.

The Economy

Healthcare is not only the largest employer but also the greatest job creator in the country. Healthcare employs more people than any other industry in the US. (4) Over the past twenty years, three out of every ten net new private jobs were created in healthcare. (5) The Bureau of Labor statistics produced maps showing the industry with the highest employment by state from 1993 to 2013. The maps illustrate how we transitioned from a manufacturing country that made stuff in 1993, to a retail country that sold stuff in 2003, then to a healthcare country that tried to heal stuff by 2013.

As previously noted in some of my blogs, the average hospital loses 9.9% in treating Medicare patients because the cost to provide the care is higher than the Medicare reimbursement. (6) Private insurance pays hospitals 241% of the Medicare reimbursement rate. (7) This means private insurance pays a hospital $2.41 for the same services the hospital is willing to sell to Medicare for $1. Shifting all payments to Medicare reimbursement would create a massive reduction in healthcare funding and, potentially, a hole in the entire economy.

In a strange economic twist, the price discrimination and administrative inefficiency in healthcare create jobs. One person’s cost growth is another person’s new job. How many jobs could be eliminated through a lower-cost and more efficient healthcare system? I don’t know, but I do know that a major reduction in the prices paid for healthcare services by those who are currently in the private insurance system would lead to a massive reduction in jobs in healthcare delivery, administration, and insurance. Direct healthcare jobs would not be the only jobs sacrificed. Healthcare construction would virtually cease with the elimination of profit in healthcare. Think about the building that used to house the Blockbuster video store in your neighborhood. There is reasonable likelihood it is now some type of health-related business. Healthcare has stepped in to fill retail space as digital services and online shopping have decreased the need for traditional retail bricks and mortar. Shrinking the healthcare economy would create a negative trickle-down impact to construction, real estate, and other industries.

Is this simply economic fearmongering? I hope not, and I don’t think so. The healthcare industry relies on the profits from the private insurance reimbursement rates. Breaking the addiction to those private insurance reimbursement rates will not be without economic side effects.

An easy answer to the economic risk of lowering all reimbursements to the current Medicare level is to increase the Medicare reimbursements. Remember the solvency challenges that the Medicare Hospital Insurance trust fund faces? The fund is projected to become insolvent by 2026 under its current structure. Increasing the Medicare reimbursement rates would only accelerate and exacerbate the current Medicare financial struggles. The current Medicare program needs more revenue and fewer expenses to remain solvent.

Access and Innovation

Medicare reimbursement rates alone cannot financially support the healthcare access that Americans have come to expect. Any system based on Medicare reimbursement rates would dramatically lower the cost of private health insurance, but affordable health insurance without adequate access to healthcare services may not be an acceptable tradeoff for voters.

The net reduction in healthcare spending creates a concern for some regarding healthcare quality and innovation. Would a reduction in reimbursements in the US for healthcare services constrict private medical research, leading to a reduction in innovation? It is difficult to predict what would happen to medical research, but the profits from private reimbursements for research funding and as a research motivator would be gone.

Government Overreach

Some simply fear government overreach in healthcare. Would a lack of service competition lead to a health-insurance service equivalent of the IRS? Would the federal government be the sole authority on care decisions? What role would the federal government ultimately play in individual wellness? Would there be a government-determined rationing of care in an effort to balance future budgets? Opponents of Medicare for all believe that private industry provides an alternative and a balance to government authority.

Republicans, Libertarians, and conservatives aren’t the only people to question Medicare for all’s wisdom. Moderate Democrats also struggle to support the progressive Medicare-for-all approach. In addition to moderate Democrats, some key leaders like Nancy Pelosi see the ACA as part of their legacy and will look to protect and fix existing law rather than to replace it with a completely different system. Some view Medicare for all as an abandonment of the ACA. Essentially, Medicare for all is “repeal and replace” from the left, rather than from the right.

What’s Next for Medicare?

Americans have a generally favorable or generally negative view of the ACA based on their political affiliation rather than their intimate knowledge of the law. Medicare for all is following the same pattern of party-line approval and lack of real understanding. Republicans rallied around “repeal and replace” without knowing what the replacement might be. Medicare for all will be the rallying cry for Progressives even if there is great confusion as to what the phrase means.

Next week, we’ll take a look at a couple of other options that have been talked about with regard to Medicare. Tune in to find out more. And, if you haven’t already, I encourage you to sign up for the “Insiders’ Club” where you’ll be notified when I release new information on my book “The Voter’s Guide to Healthcare: A non-partisan, candid, and relevant look at politics and healthcare in America.”

And great news…the book is also now available for sale on Amazon and Barnes and Noble. Check it out if you’re interested.

Sources

- The Hill. “70 percent of Americans Prefer Medicare for All Proposal.” Thehill.com. October 22, 2018.

- Yusra Murad. “Majority Backs ‘Medicare for All’ Replacing Private Plans, if Preferred Providers Stay.” Morningconsult.com. July 2, 2019.

- Kamala Harris. My Plan For Medicare For All. Medium.com. July 29, 2019.

- Derek Thompson. “Health Care Just Became the U.S.’s Largest Employer.” The Atlantic. January 9, 2018.

- Federal Reserve Economic Data (FRED). “All Employees: Total Private Industries and Education and Health Services: Health Care. 1999-07-01 to 2019-07-01.” Fred.stlouisfed.org.

- “Report to the Congress: Medicare Payment Policy.” Medpac.gov. March 15, 2019.

- Chapin White and Christopher Whaley. “Prices Paid to Hospitals by Private Health Plans Are High Relative to Medicare and Vary Widely: Findings from an Employer-Led Transparency Initiative.” Rand.org. May 9, 2019.