People in the U.S. receive their health insurance through a variety of public and private insurance programs. An introductory understanding of how people access health insurance today is needed before entering an educated discussion about how to alter, improve, or replace these programs. Talking about how to reform healthcare without first understanding the programs through which it’s delivered today and the challenges they, and the participants in them, face is like having surgery prior to diagnosing the problem. We must first examine the patient to diagnose the problems before recommending a treatment and cure.

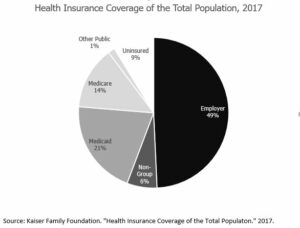

Health insurance in the U.S. is delivered through a combination of public and private programs. Almost half of all people in the U.S. receive their health insurance coverage through an employer-sponsored plan. Approximately 36 percent of Americans receive their coverage through a public plan.

The structure, funding, plan designs, and issues differ by source of coverage. This blog, along with the next few blogs, will provide a foundational introduction to these major sources of health insurance coverage.

What Is Medicare?

Medicare is a federal health insurance program that covers people age 65 or older and certain younger individuals who are disabled or have end-stage renal disease. As of May 2019, Medicare covered 60,963,217 individuals.

Traditional Medicare

Medicare isn’t one complete health insurance program; it’s actually a series of health insurance component options.

- Medicare Part A covers inpatient services and typically does not require a premium. It includes a $1,364 deductible. A daily copay begins with the 61st day of inpatient hospitalization in a benefit period. Medicare Part A limits coverage for inpatient stays to 90 days per benefit period. Sixty lifetime reserve days are also available, but these reserve days do not reset once used.

- Medicare Part B covers outpatient, physician, and professional services. The standard premium is $135.50 per month. The premiums increase based on income above $85,000 per year and can rise up to $460.50 per month. Medicare Part B includes a $185 annual deductible and 20 percent coinsurance for most services.

- Medicare Part D covers prescription drugs. Prescription Drug Plans (PDP) are administered and sold by private insurance companies. The average base premium for a Part D plan is $40 per month. Similar to Part B, additional premiums are required for individuals with income above $85,000 per year.

- Medicare Supplement plans are available to cover out of pocket expenses and items not typically covered by Medicare.

Medicare Advantage

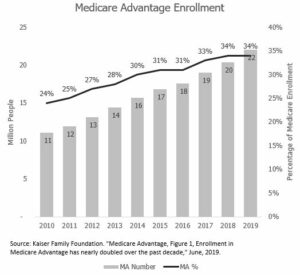

Medicare Part C is also known as Medicare Advantage (MA). MA plans are private insurance alternatives to traditional Medicare coverage. MA participants opt out of traditional Medicare and receive all of their coverage through the private market. MA plans use provider networks similar to employer-sponsored coverage. Premiums and coverage provisions vary by plan. Some plans have no deductible, and some plans are available for $0 premium. Approximately 34 percent of all Medicare enrollees participate in MA plans. The number of participants doubled from 11 million in 2010 to 22 million in 2019.

Approximately 80 percent of Medicare participants have some type of private insurance through either a Medicare Supplement or a MA plan. Medicare is considered a public insurance program, but it is delivered through a combination of public and private insurance providers and it is far from being a single-payer program.

How Is Medicare Funded?

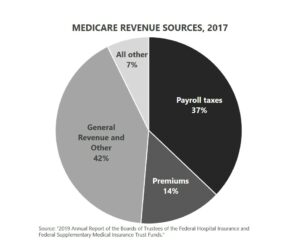

Medicare is funded on an annual basis through payroll taxes, premiums paid by participants, general federal government revenue transfers, and a list of smaller contributors like interest and taxes from benefits. Premiums paid by Medicare beneficiaries cover less than 15 percent of the annual cost.

Medicare’s near-term solvency is in jeopardy according the Medicare’s Trustees. Medicare operates two trust funds.

- The Supplemental Medical Insurance (SMI) trust fund is used for Medicare Parts B and D. The SMI trust fund is considered adequately funded because the revenue and premium are reset each year.

- The Hospital Insurance (HI) trust fund is dedicated to Medicare Part A. The HI trust fund is projected to be depleted by 2026 because expenses are projected to be larger than revenues each year. The Medicare Trustees are required to issues warnings when the Medicare trust fund falls below specified levels. Funding projections in the 2019 Trustee report triggered a Medicare funding warning that (i) requires the President to submit to Congress proposed legislation to respond to the warning within 15 days after the submission of the Fiscal Year 2021 Budget and (ii) requires Congress to consider the legislation on an expedited basis. This is the third consecutive year that a determination of excess general revenue Medicare funding has been issued, and the second consecutive year that a Medicare funding warning has been issued.

A Ponzi scheme is a fraudulent financial program in which money coming in from new investors is paid out to prior investors. The end result is that there is truly no money or assets in the end. In some ways, you could consider the Medicare trust funds and financing to be a type of benefit Ponzi scheme. Medicare taxes paid by you and your employer do not go into a fund to pay for your future Medicare benefits. The money you and your employer pay this year goes to pay for Medicare beneficiaries this year. If the trust fund had to fund Medicare without additional revenue sources, the fund would be exhausted before the end of May in the first year. Although there is a trust fund, Medicare is a cash flow business and must be constantly funded.

Wait…there’s more! The U.S. has two types of debt. There is the more commonly discussed debt held by the public. This is the debt the Congressional Budget Office typically uses when addressing our national debt. There is also a second, lesser-known type of debt known as intragovernmental debt. As of December 2018, the federal government has borrowed $304.3 billion from the Medicare trust funds through intragovernmental debt. This is almost the entire trust fund balance.

So, what does this really mean? It means the money in the Medicare trust funds has been loaned to the federal government and has already been spent on other things. A comparison to your 401(k) might help explain. Assume you put $10,000 per year into your 401(k) for 20 years. After the 20 years, you deposited $200,000 into your account. However, you decided to take annual loans in the amount of $10,000 out at the end of each year, totaling $200,000 in loans. You did not repay any of the loans. If you retired at the end of the 20-year period, how much money would you have in your 401(k) for retirement? The simple answer is almost nothing, because you borrowed everything you deposited to spend on other things. The federal government has done the exact same thing to the Medicare trust funds.

Medicare and American Demographics

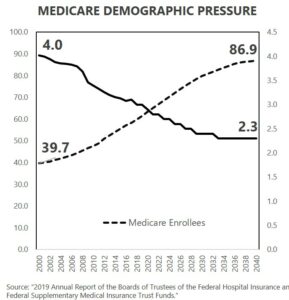

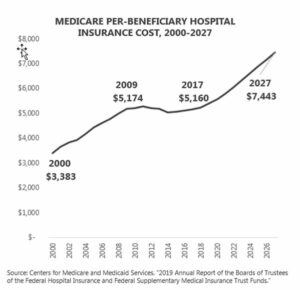

Federal government net Medicare expenditures have been growing as a percentage of gross domestic product (GDP). The combination of changing demographics and healthcare inflation create financial pressure for Medicare. Between 2000 and 2018, the number of workers in the country per beneficiary dropped from 4.0 to 3.0. Put another way, in 2000, four workers were paying taxes to fund Medicare for every one person receiving Medicare benefits. It is now just three workers paying Medicare taxes for each beneficiary. This ratio will continue its downward slide over the next decade as baby boomers continue to age into Medicare.

The result of the demographic shift is intense financial pressure on Medicare’s sustainability within the current tax structure. Does this mean Medicare will financially crash and go out of business? No, but it does mean that Medicare will need more money to pay its bills than the current financing structure creates. Some combination of reduced expenditures, increased premiums, and increased taxes will be needed. Status quo means acceleration of the federal deficit through a growing Medicare funding shortfall.

What’s Next?

The combination of the demographic aging in America and healthcare inflation put tremendous pressure on the Medicare trust funds and on the federal budget in total. Medicare is not adequately financed under its current structure. Politicians on the left are lining up in support of Medicare eligibility expansion or even “Medicare for All” without discussing the details of how this eligibility expansion would either help or hinder the current Medicare financing challenge. The debate regarding who is, and who is not, eligible for Medicare is setting up to be among America’s most hotly debated subjects in the coming years.

Do you agree? I’d love to hear your thoughts on that.

And, be sure to tune in next week where I’ll take a look at Medicaid basics and how it will impact the political debates. If you haven’t already, I encourage you to sign up for our “Insiders’ Club” where you’ll be notified when I release new information AND receive a FREE copy of my book “The Voter’s Guide to Healthcare: A non-partisan, candid, and relevant look at politics and healthcare in America” when it’s available.