The Affordable Care Act (ACA) completely redefined the individual insurance market:

- Underwriting based on health status (aka preexisting conditions) was outlawed.

- Premiums are based on age, but the age tiering is now government-set, and cost of the highest-cost age band is capped at three times that of the lowest.

- Insurance companies must spend 80 cents of every dollar on claim expenses, or they must refund participants the difference.

- Plan designs must align with one of four metallic values — platinum, gold, silver, or bronze.

- Annual and lifetime plan maximums are outlawed.

- Each plan must cover a list of essential benefits.

- Rate increases require federal government approval.

- A refundable tax credit subsidy system was created to help individuals and families at less than 400 percent of the FPL pay for health insurance.

Put simply, the individual health insurance market is now completely regulated. Benefits, underwriting, and rates are all regulated. Every American can now buy individual health insurance without the worry of preexisting-condition limitations, but the affordability of the coverage is still very much in question.

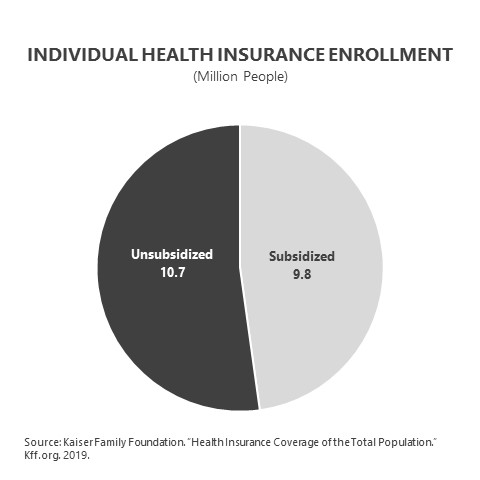

According to the Kaiser Family Foundation, 20,525,500 people bought individual nongroup health insurance through a variety of channels in 2017. Approximately 9.8 million individuals purchased subsidized individual health insurance, and approximately 10.7 million people purchased individual coverage through any source without financial assistance.

Although those purchasing individual health insurance with and without a subsidy have the same plans available from the same insurance companies, the economics of their health insurance are worlds apart.

Nonsubsidized Markets

Inflation rates vary greatly among health insurance sources. According to data tracked by the Centers for Medicare & Medicaid Services, the inflation rate for health insurance purchased on a direct basis in the individual health insurance marketplace rose more than three times the rate for employer-sponsored insurance and almost 15 times the rate of Medicaid.

Those who are purchasing individual coverage using Obamacare subsidies have been shielded from these increases because the subsidies increase to cover the price increases. Approximately 10.7 million people purchase individual health insurance without government subsidy assistance, however. These individuals have felt the full economic weight of the health insurance cost increases.

The Direct Purchase group in the chart represents the individual health insurance market. So why did the individual market health insurance premiums skyrocket in comparison to other types of insurance? The elimination of underwriting rules and plan maximums has led to dramatically increased claims that result in dramatically increasing premiums. The health insurance premium rates for individual health insurance are the same for the subsidized and nonsubsidized participants, and the large claims and losses for the subsidized population are pooled with the nonsubsidized group. The biggest losers, when talking about health insurance premium increases, have been the nonsubsidized individual health insurance purchasers.

The largest premium spike occurred January 1, 2017. Even after insurance-carrier, provider-network, and plan-design changes, the average premium increased 21 percent. These rate increases caused many in the nonsubsidized population to reevaluate the value of health insurance. Health insurance participation among people purchasing nonsubsidized coverage decreased by over 20 percent. Without financial subsidy, many decided that individual health insurance was too expensive and that they would go without it.

In addition to premium increases, individual purchasers face significant out-of-pocket costs. Consumer decisions in health insurance are very different when the consumer is spending his or her own money. Those without a subsidy choose a far less rich plan design. More than half of the nonsubsidized participants choose a bronze-level plan that has a 60 percent actuarial value, meaning the plan covers approximately 60 percent of eligible expenses. More than half the subsidized participants receive plans with actuarial values at or above the gold value, which covers 80 percent of eligible expenses.

How expensive is the individual health insurance market? As an example, I pulled the following quotes for insurance for a 54-year-old in Dallas, Texas, in February 2019. I selected a bronze, silver, and gold plan available from Blue Cross Blue Shield of Texas for comparison. Bronze plans have lower premiums but typically have higher deductibles.

The bronze plan example costs $7,863 per year in premium and has a deductible of $6,000. A covered person effectively has $13,863 (the sum of the deductible plus the premium) of expense before the plan starts covering healthcare expenses. If the person is covering a spouse of the same age, all numbers are multiplied by two to get the cost for the household!

Rising premiums and increasing out-of-pocket costs are unfortunately not the end of the cost story for individuals purchasing without a subsidy in the individual market. They purchase health insurance in a discriminatory tax environment. Those who receive subsidies from their employers or from the government are not taxed on the subsidies they receive. In addition to tax-free subsidies, employees who purchase health insurance through their employers can do so with pretax contributions. Individuals who buy insurance outside of employer coverage must do so with posttax dollars. This discriminatory tax treatment effectively makes the health insurance cost for the nonsubsidized individual purchasing health insurance even more painful on the pocketbook.

Subsidized Marketplace

The ACA subsidy system was designed to shield participants from health insurance rate increases, and it has worked as designed. In a bizarre twist of math reality, the net cost of coverage for those who receive subsidies can actually decrease when the insurance premium rate rises. This happens because the increased premium increases the subsidy. Net premium rates for subsidized individuals have decreased in recent years. Yes, health insurance costs have decreased for Marketplace participants.

The percentage of Marketplace enrollees receiving a subsidy has increased to 87 percent of all enrollees, and the average subsidy has reached 86 percent of premium. The significant premium increases created even larger percentage increases in the subsidies. The net result since 2016 is growth of 86 percent for the average subsidy and a decrease of 18 percent in the net cost paid by participants.

Choice

For those who receive subsidies, choice has been the big newsmaker. The news quieted down in 2019 as the percentage of people with three or more insurance carrier options increased, reversing a trend in decreasing choice. In 2015, 87 percent of consumers had a choice of three or more insurers, but by 2018, this had dropped to 45 percent. Obamacare advocates were worried that decreasing choice could lead to a collapse in the Marketplace because of the lack of competition; Obamacare opponents used the declining choice as a signal of the ACA’s pending collapse.

The uncertain enrollment, too many high-cost claimants, and congressional uncertainty around funding for Obamacare cost-sharing reductions created an unpredictable financial environment for insurance companies. Health insurance actuaries and underwriters like uncertainty about as much as Dracula likes eating garlic in the sunlight. Premium rates have increased to account for the comparably poor risk in the covered population and to capture the cost-sharing reduction funding within the rates for everyone. These dramatic rate increases have moved the insurance companies into a place of more predictable profitability. The improved profitability is resulting in increasing choice for consumers. As much as it might frustrate Obamacare haters, many of the Trump administration’s decisions have brought price stability to the ACA Marketplace and are helping to bring more choice back to Marketplace participants.

Individual Coverage Recap

- The ACA regulates the individual insurance market pricing, underwriting, and plan designs.

- Subsidized participants have been shielded from rate increases.

- Nonsubsidized participants have absorbed large rate increases and do not receive the tax advantages of those covered by employer-sponsored health insurance.

- Price and choice stability appear to be replacing the individual market volatility of the first years after ACA implementation.

What’s Next?

Rates have stabilized, subsidies have increased, and choice is returning to the subsidized Marketplace. Democrats don’t want to give Republicans credit for fixing Obamacare, so they don’t talk about it. Republicans don’t want to take credit for fixing something they were trying to repeal and replace, so they don’t talk about it. Expect the moderate Democrats to push for a public plan option, like Medicare, for Marketplace participants.

The unsubsidized individuals purchasing through the individual health insurance market face the most immediate pain. They need rate relief and are also looking for tax equality with employer-sponsored participants.

Legislators feel pressure to add choice to the Obamacare Marketplace. New options should apply to both the subsidized and nonsubsidized participants. Whether it is an option to buy in to Medicare or Medicaid, or the development of a public plan option, the addition of a government-based option will be a hotly debated subject in the very near future and will be a key issue for these voters.

Thoughts about all of this? I’d love to hear from you!

Next week, I’ll take a look at the uninsured and what it means to you. Be sure to tune in. And, if you haven’t already, I encourage you to sign up for our “Insiders’ Club” where you’ll be notified when I release new information AND receive a FREE copy of my book “The Voter’s Guide to Healthcare: A non-partisan, candid, and relevant look at politics and healthcare in America” when it’s available.