-

Industries

-

Groups & Associations

-

Solutions

Looking for something else?

View all our services

- Captive Insurance

- Claims

- Clinical Wellbeing

- Complex Property

- Compliance

- Cyber Liability

- Data Analytics

- Employee Benefits

- ESG Consulting Services

- Executive Risk

- Global Risk Management

- Innovation

- Pharmacy

- Placement

- Private Risk

- Programs

- Property Casualty

- Risk & Safety

- Small Business

- Specialty Benefits

- Surety Bonds

- Third-Party Claims

- Workers' Compensation

Why Holmes Murphy

Discover what makes us unique and how we deliver the best insurance solutions tailored to you.

Family of Brands

Explore Holmes Murphy's innovative approach to provide meaningful value to our clients through our PLUS companies.

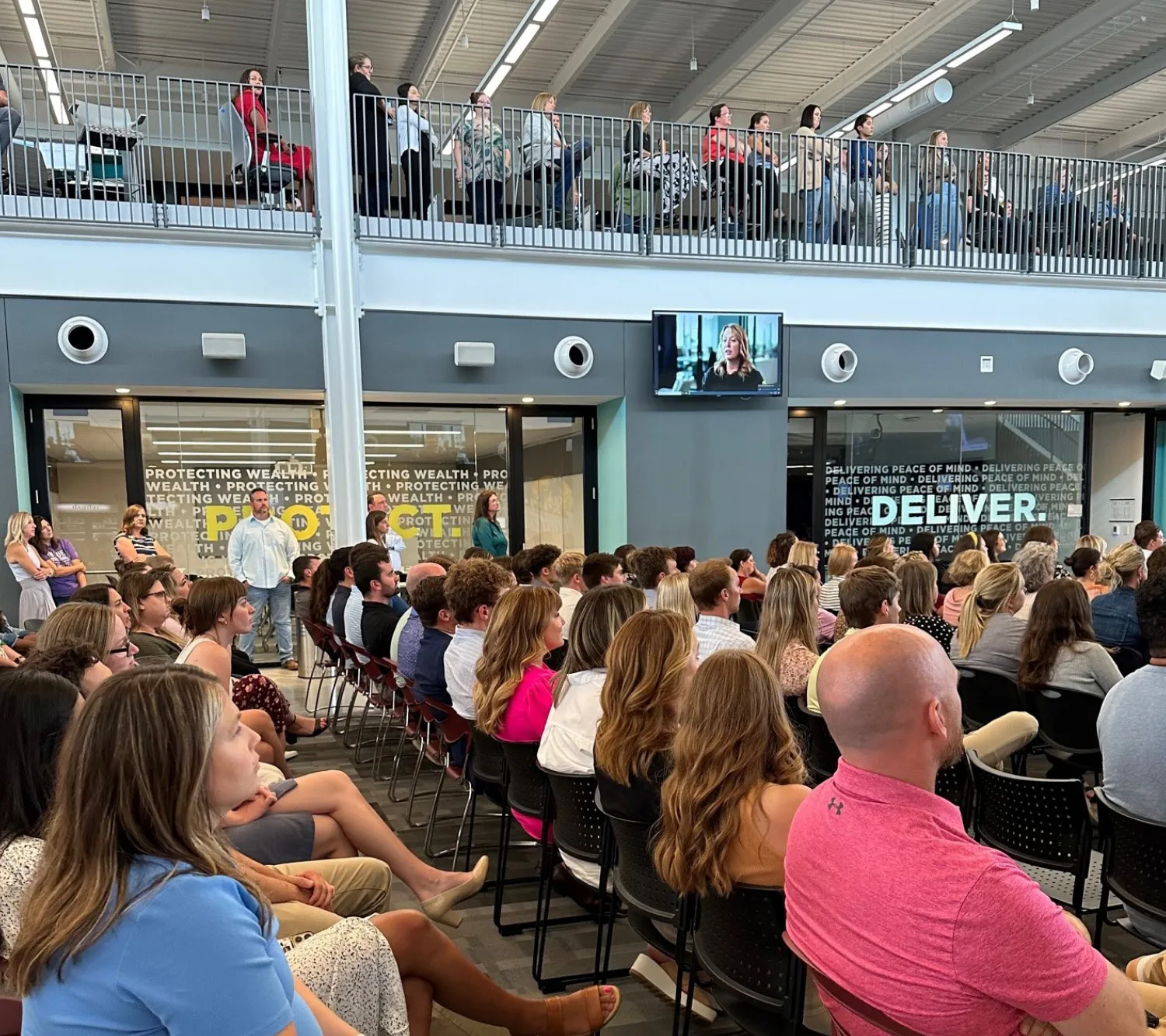

Careers at Holmes Murphy

Ready to find your dream career? Learn more about life at Holmes Murphy and everything we have to offer.

Why Choose Holmes Murphy?

Check out our Careers video library to hear why our employees love what they do and who they do it with.