As the Affordable Care Act (ACA), often called Obamacare, celebrates the 10th anniversary of its go-live date, many in the industry are considering how the ACA impacted healthcare for the majority of Americans. For this blog, I’ll be exploring the ACA’s impact on people with employer-sponsored plans, which is how more than half of working-aged Americans and their families get health insurance coverage.

Some would say Obamacare saved healthcare, while others wouldn’t speak so highly of it. Most wouldn’t argue that those receiving Medicaid as a result of expanded coverage or getting a subsidy to buy reduced cost coverage in the Marketplace/Exchanges have not been helped.

However, most working-aged Americans continue to purchase health insurance through their employer. If that’s the case, then how has Obamacare impacted the majority of Americans?

Americans Without Employer-Sponsored Plans Benefitted From ACA

Consider what the ACA was presented to accomplish. In President Obama’s address on June 6, 2009, he said, “If you like the plan you have, you can keep it. If you like the doctor you have, you can keep your doctor, too. The only change you’ll see are falling costs as our reforms take hold.”

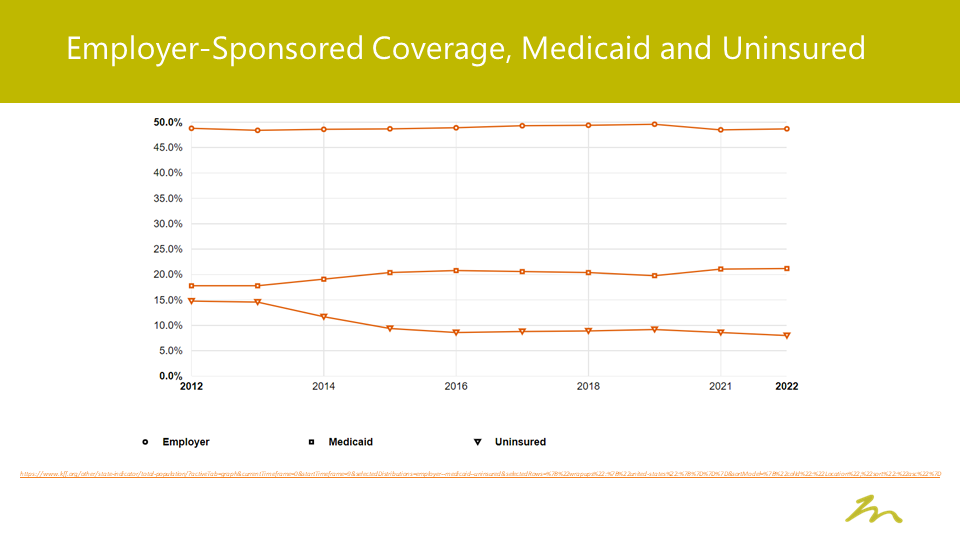

That statement proved to be partially correct. The percentage of Americans who continue to receive health insurance through their employer is effectively unchanged in the ten years since the implementation of the ACA. The chart with data from KFF an independent source for health policy research and polling below shows the percentage of Americans who get their health insurance from an employer-sponsored health plan, have Medicaid, or are uninsured.

As noted, there is almost no change in the percentage of employer-sponsored coverage, while Medicaid coverage expanded health insurance coverage for many Americans who were previously uninsured.

Healthcare Costs Continue to Rise for Employer-Sponsored Plans

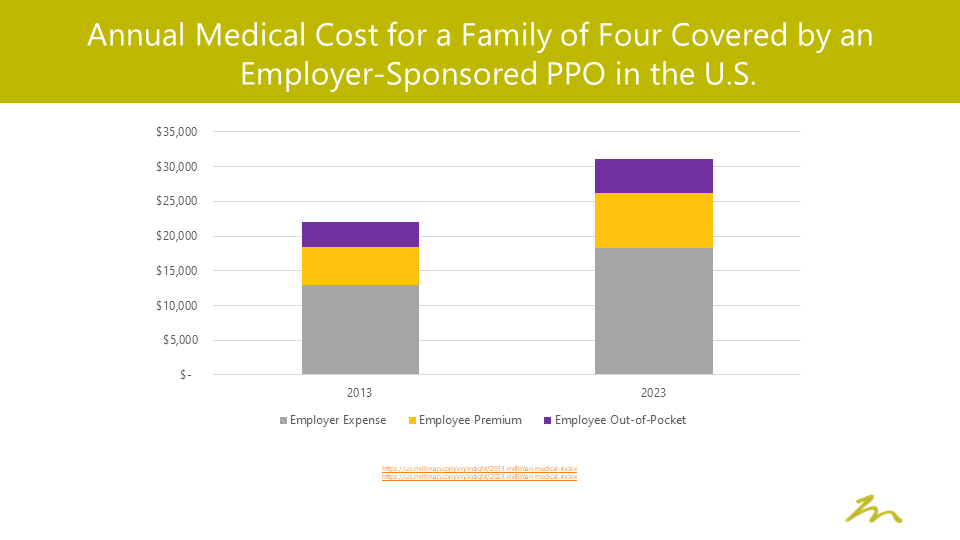

The first part of President Obama’s statement proved true; however, we are not seeing the “falling costs”. Let’s compare data from the 2013 Milliman Medical Index and the 2023 Milliman Medical Index. Looking at the period between 2013 and 2023 we can see costs for people buying employer-sponsored health insurance have increased for both employees and employers.

On this metric, many Americans – considering that the majority utilizes employer-sponsored plans – have seen healthcare costs increase by an average of 40% since the passage of the ACA.

Minimum Loss Ratio

The ACA attempted to control costs by requiring a minimum loss ratio (MLR) for insurance carriers. However, approximately two-thirds of employer plans are self-funded rather than fully insured, meaning the MLR provision affected a minority of Americans since the true expense of health insurance is driven by the cost of care rather than the underwriting margin.

In this case, the ACA MLR provision targeted plans that only impacted about 1 in 6 Americans.

Preexisting Conditions

Finally, as it relates to changes in coverage, the ACA was applauded for removing pre-existing conditions as a barrier to Americans purchasing health insurance. It mandated that pre-existing conditions, which risked being excluded from most individual health insurance products prior to the ACA, could not be excluded from coverage or result in higher premiums.

However, for employer-sponsored plans, the passage of HIPPA in 1996 and HIPPA’s Privacy Rule effectively eliminated the enforcement of pre-existing practices such as exclusion based on pre-existing conditions, so this portion of the ACA had limited impact for the majority of Americans relying on employer-sponsored plans.

ACA’s Impact Not Felt by Employer-Sponsored Plans

As we look back on the impact of the ACA over the past decade, we see an uncertain legacy as to what it will ultimately mean for Americans and their health insurance. The number of uninsured Americans significantly decreased and Medicaid membership has grown through expansion of eligibility.

But for those with employer-sponsored plans who account for most of those insured in the United States, the primary difference they have seen over the past decade is a 40% increase in the amount they spend on health insurance and healthcare. Ultimately, the ACA wasn’t designed for the majority.

For those of us with employer-sponsored plans, this might seem like a bleak conclusion. However, employers continue to consider new ways to address rising healthcare costs for their business and employees.

If you’re ready to rethink how your organization approaches employee benefits, reach out today and let’s have a conversation!