Families everywhere are reviewing budgets amid persistent inflation, high healthcare costs, and the looming tax season. In my last blog, I introduced the Trust Equation and how it underpins strong leadership, sales, and relationships. Building on that foundation, financial wellness ties directly into trust—employees need to feel secure and supported. This requires credibility in your Employee Benefits strategy, reliability in delivery, intimacy through genuine care, and low self-orientation by focusing on their needs over just checking boxes.

Anyone who knows me knows I’m a linear thinker. When I started digging into how financial stress is impacting employee performance and retention, it didn’t surprise me that I latched onto a formula to make sense of it.

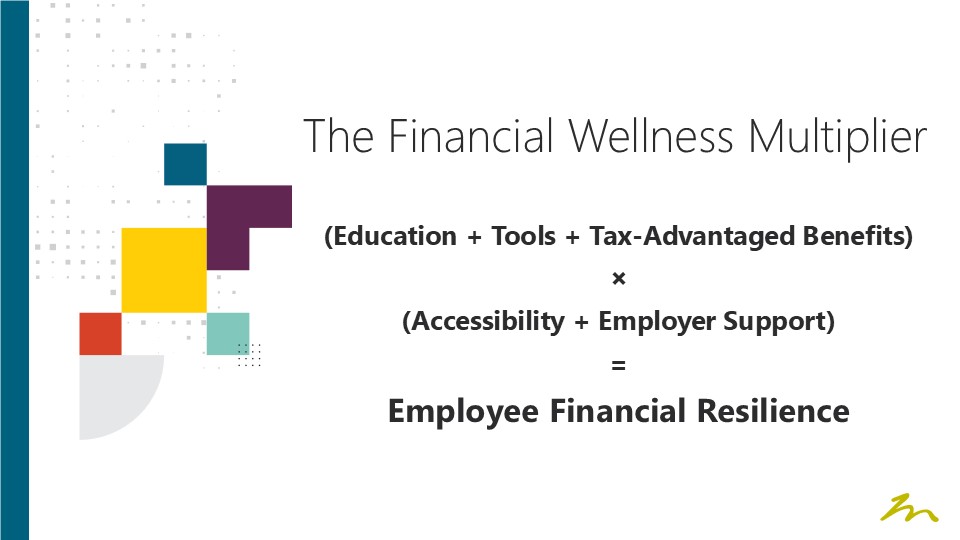

Meet the Financial Wellness Multiplier: (Education + Tools + Tax-Advantaged Benefits) × (Accessibility + Employer Support) = Employee Financial Resilience.

Like the Trust Equation, it’s simple math for a complex problem.

Why Financial Wellness Matters

Financial wellness isn’t just a “nice-to-have” anymore. 77% of employees are stressed about the economic climate, inflation driving up everyday costs, healthcare expenses climbing, and reassessing budgets post-holidays, 62% of employers are expanding non-medical offerings. Why?

Financial stress reduces engagement, productivity, and loyalty. Multiply strong education, tools, and tax savings with accessible, supportive structures, and you get resilient employees who stay focused and committed.

When you apply the Financial Wellness Multiplier, the goal is to maximize components on the left side of the equation while amplifying them through the right side for exponential impact.

The Financial Wellness Multiplier in Action

Once you understand the variables, it’s easy to see how each enhances financial security in your relationships—whether with teams, clients, or partners.

Education

Do your employees understand money basics? Build confidence by offering workshops, online modules, and one-on-one coaching. Personalized financial literacy programs are also trending. These programs cover budgeting, debt management, and retirement planning—perfect for early-year financial reviews.

Tools

Can your employees apply what they learn? Budgeting apps, debt payoff calculators, and emergency savings programs (like payroll-linked rainy-day funds) are surging. Other trending non-medical benefits include:

- Student loan repayment assistance

- Lifestyle Spending Accounts (LSAs) for perks like gym memberships or pet care

- Financial coaching sessions

- Low-interest employee loans for emergencies

Innovative benefits can creatively address real-life pressures like inflation, housing costs, and high healthcare costs.

Tax-Advantaged Benefits

Are your employees capturing real savings? This is where Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and Limited Purpose FSAs shine. Pre-tax contributions lower taxable income—often saving 20-40% depending on tax bracket—while covering qualified expenses, making them ideal pre-tax-season tools.

- HSAs: For 2026, individuals can contribute up to $4,400, families up to $8,750 (plus $1,000 catch-up for 55+). Funds roll over indefinitely, can be invested, and are portable. Pair with a high-deductible health plan for triple tax advantages: pre-tax contributions, tax-free growth, tax-free withdrawals for medical expenses.

- FSAs: Use pre-tax dollars for medical or dependent care, up to $3,400 for health FSAs. The dependent care limit hits $7,500 per household—great for daycare or elder care.

- Limited Purpose FSAs: Up to $3,400 alongside HSAs, covering dental and vision without disqualifying HSA eligibility, maximizing tax savings on non-medical health needs.

These turn everyday costs into savings, freeing money for goals like emergency funds or student loans—which can be crucial amid inflation.

Accessibility and Employer Support

Is it easy and encouraged for your employees to engage with their benefits? Simple enrollment, mobile apps, and clear communication lower barriers. Matching contributions to HSAs or emergency funds, plus active promotion, can amplify efforts.

Lead With Financial Wellness

Ever had a team distracted by money worries? Low resilience leads to absenteeism and turnover. But leaders who prioritize this multiplier with credible education, reliable tools, and employee-focused support build engaged, productive teams that trust their guidance.

Enhancing financial wellness isn’t the only positive outcome. People connect with those who make them feel secure. Nail this multiplier, and relationships grow. Employees feel valued when their needs are met with accessible tools and wellness strategies that alleviate concerns and empower their potential.

So, ask yourself:

- Are we offering solid education and trending tools?

- Do we leverage HSAs, FSAs, and non-medical perks for maximum savings?

- Is access seamless with strong support?

- Are we focused on employee success, not just compliance?

If your answer is no to any of these questions, integrating the Financial Wellness Multiplier can take your benefits strategy to the next level. With powerful understanding, insights, and impact, our team is here to help you maximize your success. Contact us today to learn more.